Key Takeaways

- Tailor policies, communication, and services to individual customer needs and life stages.

- Implement digital tools for policy management, claims processing, and health engagement to enhance customer experience.

- Be genuine. Offer programs and incentives that promote preventive care and healthy lifestyles.

- Use predictive analytics and customer insights to drive retention strategies and improve services.

Customer retention is more than a metric in insurance—it drives profitability and sustainable growth. But, as the landscape changes and consumers seek more for their money, it’s necessary to adapt and implement innovative retention strategies. As long as insurance customer churn remains a talking point, it’s also important to keep a competitive edge. This article will explore nine proven customer retention strategies in life and health insurance to keep your customers loyal. Whether you’re a life insurer looking to increase customer touchpoints or a health insurer looking to provide real value, these strategies offer a way to better, sustainable customer retention.

Life vs Health Insurance Retention

Before diving into specific strategies, we should recognize that while life and health insurers share similar goals in customer retention (and acquisition/engagement), their approaches may differ due to the nature of their products and relationships.

Life insurers

Life insurers face the challenge of maintaining long-term relationships with fewer touchpoints. Policies often span decades, and customers may interact with their insurer only a handful of times after the initial purchase. Key retention challenges include:

- Keeping policies relevant as customers move through life’s stages.

- Demonstrating ongoing value in the absence of regular claims.

- Competing with other financial priorities.

Health insurers

Health insurers manage more frequent customer interactions but face higher churn rates due to annual enrollment periods and changing life and health circumstances. Their retention challenges include:

- Managing customer satisfaction through frequent claims.

- Balancing premium costs with comprehensive coverage.

- Differentiating their offerings in a highly competitive and often commoditized market.

Despite these differences, both life and health insurers can benefit from strategies that enhance customer engagement, personalize experiences, and demonstrate ongoing value. Insurers can adapt to create tailored retention strategies by understanding and addressing these sector-specific challenges.

9 Customer Retention Strategies in Insurance

1. Personalized Policy Management

Tailored Coverage Options

Offer customizable policies based on life stages, family needs, and health conditions. For life insurance, tailor policies for different phases, such as parenthood or retirement. This might include adjustable term lengths or conversion options. Health insurers can offer customizable riders like dental and vision add-ons or international travel insurance. The key is allowing policyholders to adapt their coverage as their needs change.

Life Events Adjustments

Proactively reach out to policyholders during major life events to suggest appropriate policy adjustments or upgrades. Both life and health insurers might recommend increasing coverage after the birth of a child or adding a spouse to the policy after marriage. This approach demonstrates attentiveness to changing customer needs and helps prevent coverage gaps.

Ongoing Needs Assessments

Conduct regular policy reviews with customers to ensure their coverage still fits their needs as they age or experience life changes, reinforcing your commitment to long-term care. This might involve annual reviews to discuss changes in financial and family situations. Insurers can use these assessments to educate customers about new products or services that might better suit their evolving needs.

2. Simplified Claims Process

Efficient Claims Processing

Streamline the claims process for both life and health insurance to make it as quick and stress-free as possible. For life insurance, this might involve creating a dedicated team to handle certain benefit claims and ensure sensitive and efficient processing during a difficult time for beneficiaries. Health insurers can expedite reimbursements for out-of-pocket expenses.

Digital Claims

Allow customers to file claims via online platforms or mobile apps with minimal paperwork and enable real-time tracking to enhance transparency and reduce frustration. Create user-friendly portals where beneficiaries can submit necessary documents securely and allow policyholders to submit claims by simply taking photos of medical bills or receipts.

Claims Transparency

An Accenture report links claims transparency with high satisfaction (70%) in insurance. This improvement in satisfaction directly correlates with higher retention rates. Implementing a simplified claims process can particularly impact health insurers, as policyholders interact with the claims system regularly. While claims are less frequent for life insurers, a smooth process can influence the likelihood of beneficiaries becoming customers.

3. Health and Wellness Programs

Preventive Health Programs

Offer health and wellness programs that incentivize policyholders to adopt healthier lifestyles. Health insurers can provide access to health tracking, discounts on gym memberships, or smoking cessation programs. Health and life insurers can partner with health platforms like dacadoo to encourage healthier behaviors, reduce claims, and improve customer satisfaction.

Telemedicine and Health Tools

Provide access to telemedicine services, mental health apps, fitness trackers, and health monitoring tools. For health insurers, this could mean offering personalized health insights, which can help reduce claims by addressing health issues early. Life insurers can partner with telemedicine providers to offer policyholders access to physical and mental health assessments, which can help customers better understand and manage their health risks.

Wellness Rewards

Implement a rewards program that provides points or discounts for participating in health assessments, attending wellness webinars, or tracking fitness goals through wearable devices. An Accenture survey revealed that 69% of consumers would share more personal data for better pricing on insurance products, which opens up opportunities for insurers to tailor services based on data. dacadoo’s Digital Health Engagement Platform (DHEP) can give insurers health data while ensuring privacy and security for policyholders.

4. Regular Customer Communication

Health Education and Advice

Regularly communicate tips and guidance on managing health, preventing illnesses, and understanding policy benefits. Send monthly newsletters with seasonal health tips, information about lifestyle choices and long-term health, and reminders for preventive screenings. Also use blog posts, webinars, or podcasts to deliver this content, catering to different customer preferences.

Personalized Messaging

Use data-driven insights to send personalized emails or messages regarding individual health trends, changes in coverage, or relevant offers based on the customer’s policy type and life events. This strategy is particularly effective when combined with insights through digital engagement platforms like dacadoo, which lets insurers create more relevant interactions that demonstrate the ongoing value of the policy.

5. Loyalty Programs and Incentives

Loyalty Discounts

Provide long-term policyholders with premium reductions, free health assessments, or enhanced coverage for their continued loyalty. Health insurers might offer incrementally lower deductibles for each year a customer remains with the plan. Life insurers could provide loyalty bonuses through cash value accumulation for permanent life policies. Both types of insurers can consider offering multi-product discounts for customers with multiple policies (e.g., combining home, car, life, and health insurance where applicable).

Referral Bonuses

Encourage current policyholders to refer new customers by offering incentives like premium discounts, gift cards, or loyalty points for successful referrals. Health insurers might offer a period of free coverage for each successful referral. Health and life insurers can implement tiered referral programs where the rewards increase with successful referrals, encouraging ongoing customer advocacy. Offer rewards to both the referrer and the new customer to increase the program’s appeal.

6. Digital Engagement and Tools

Mobile Apps

Create apps that allow customers to manage their policies, file claims, check their health benefits, and engage with wellness programs all in one place. For health insurers, these apps can include features like provider directories and claims tracking. Life insurance apps might focus on policy management and beneficiary updates. Both can incorporate wellness tracking features, leveraging smartphone capabilities to monitor physical activity, sleep patterns, and stress levels.

Self-Service Portals

Offer user-friendly, accessible online portals where customers can update their personal information, track policy details, pay premiums, and access health advice. Health insurers can provide detailed explanations of benefits, cost estimators for common procedures, and secure messaging with customer service representatives. Life insurers might offer tools for adjusting coverage amounts or managing investment components of permanent life policies.

Interactive Tools

Implement interactive calculators or tools that help customers understand coverage, calculate premiums, or see the benefits of upgrading their policy. An Ernst and Young Global Insurance Survey found that 80% of customers also want to use digital tools for tasks and transactions. By partnering with dacadoo, insurers can integrate app insights to create a more engaging and valuable digital experience for policyholders.

7. Educational Initiatives

Health and Life Insurance Literacy

Offer webinars, guides, or blog content to educate customers on the importance of life and health insurance, choosing the right coverage, and managing their health. Health insurers can focus on topics like understanding health plan terminology, maximizing benefits, and navigating the healthcare system. Life insurers can provide educational content on different types of life insurance, the role of life insurance in financial planning, and how to determine appropriate coverage levels.

Preventive Healthcare Content

Provide customers with resources that promote preventive healthcare, helping them understand how their insurance can support long-term health and well-being. Health insurers can create comprehensive wellness libraries with articles, videos, and interactive tools covering topics like nutrition, exercise, mental health, and disease prevention. Life insurers can play a role by educating customers on how lifestyle choices impact life expectancy and insurance premiums.

8. Community Engagement and Social Responsibility

Social Responsibility Initiatives

Build stronger emotional connections by actively engaging in initiatives that resonate with customers. In a Bain & Company survey, 80% of respondents said they want insurers to embed environmental, social, and corporate governance (ESG) initiatives into their proposition. Sponsor free health screenings in low-income areas, support mental health awareness campaigns, or fund research into chronic disease prevention.

Charity Tie-Ins

Offer customers the option to donate a portion of their premium to a health-related charity, which can deepen their connection to the insurer and build goodwill. Health insurers might partner with disease-specific research foundations, allowing customers to direct donations to causes that personally affect them or their loved ones. Life insurers could collaborate with charities that support families who have lost a parent, aligning closely with their core mission of providing financial security.

9. Data-Driven Retention Strategies

Predictive Analytics

Leverage customer data to predict which policyholders are at risk of lapsing and reach out proactively with personalized offers or services to retain them. A McKinsey report shows that insurers who employ advanced data analytics can see their customer retention jump from 5% to 10%. How? Health insurers can analyze claims data, engagement with wellness programs, and customer service interactions to identify patterns that might indicate dissatisfaction or a likelihood to switch providers. Life insurers can use data on life events, financial behavior, and policy engagement to predict when customers might consider canceling or reducing coverage.

Risk Monitoring

Monitor health risks, encourage preventive care, and offer premium discounts for healthy behavior. This could involve partnering with health-tracking apps like dacadoo to offer discounts and using the data to provide personalized health recommendations and incentives for meeting health goals. Life insurers can also benefit from this approach, using health and lifestyle data to understand a person’s lifestyle, leading to more accurate risk assessments.

Customer Lifetime Value (CLV)

Focus retention efforts on high-value customers by offering enhanced services, benefits, or loyalty perks to increase their lifetime value to the insurer. Health insurers might offer customers dedicated account management or better coverage for select therapies. Life insurers could provide high-value customers with financial and insurance planning services. Both can offer tiered loyalty programs where benefits increase with the customer’s CLV.

The Digital Engagement Gap + Case Study

Life and health insurers traditionally only interact with customers during policy purchases and claims, missing opportunities for deeper engagement which leads to retention. Bain & Company research shows that in life and health insurance, “customers would most value rewards for healthy living” through digital engagement platforms. To bridge this gap, forward-thinking insurers are partnering with specialized technology providers to transform occasional touchpoints into valuable daily interactions. dacadoo offers insurers the digital health capabilities they need to create meaningful customer relationships.

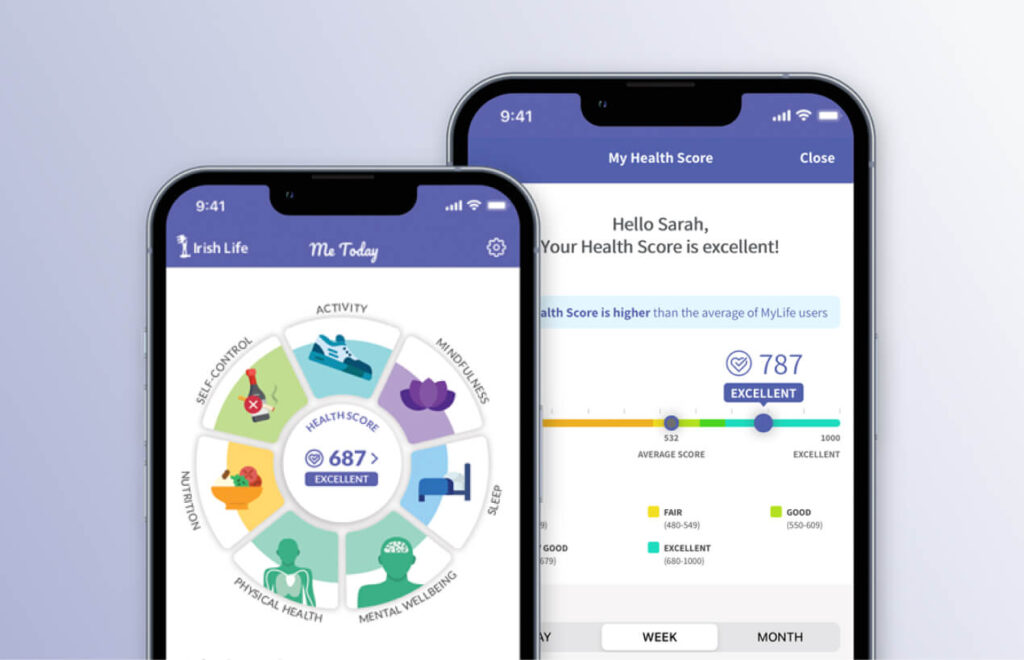

One insurer that has successfully implemented this approach is Irish Life.

Irish Life: Driving Retention Through Digital Wellness

Irish Life, one of Ireland’s leading life insurance and pension providers, faced a challenge common to insurers: standing out in a cluttered market while helping people live a healthy life and maintaining long-term relationships. To address this, they launched MyLife, Ireland’s first scientifically-backed digital health platform, partnering with dacadoo to create daily meaningful touchpoints with customers. The solution combines personalized health coaching, rewards, and social challenges to keep users actively engaged with their insurance provider. By incentivizing sustainable health improvements and offering customized well-being challenges, Irish Life transformed its traditional insurance relationship into an interactive health partnership. Since its launch in 2019, MyLife has demonstrated consistent year-over-year growth in user adoption, showing how insurers can leverage digital health engagement to strengthen customer relationships and improve retention through daily interactions.

Read more here

Insurance Customer Retention with dacadoo

By recognizing their policyholders’ unique needs and interactions, insurers can create a well-considered retention strategy that resonates with their customer base. To take your customer retention strategies to the next level, consider partnering with dacadoo for insurers. The global digital health market was valued at $211 billion in 2022 and is projected to grow at a compound rate of 18.6% until 2030. Stay ahead of the curve and book a demo to see how you can transform your health and life insurance customer base into loyal members.